A summary of STR’s European Hotel Analysis

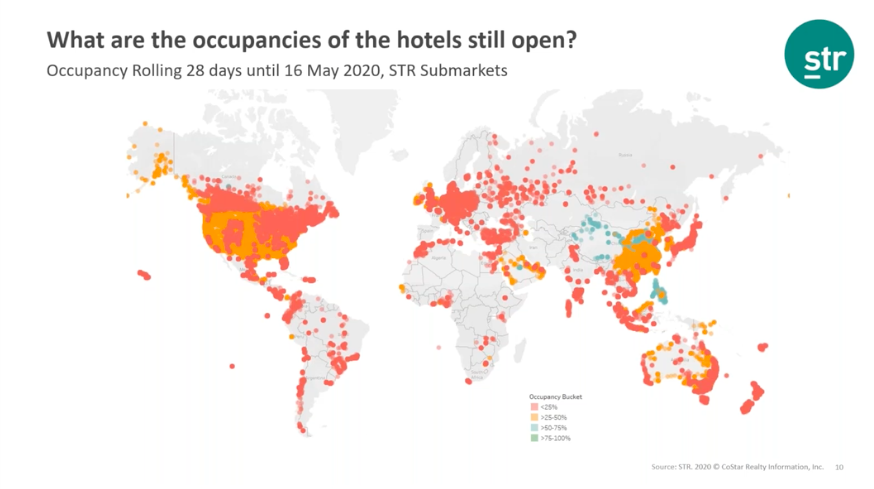

As a result of the corona pandemic, 100’s of thousands of hotel properties find themselves in financial distress. But as hotels properties are hard to repurpose, they have no choice but to re-open and redefine the dialogue between the hotel owner and operator to find a way forward together.

Hotel owners are the hardest hit in this crisis and need to assess the possibilities of restructuring the debt of their properties.

Key to this will be benchmarking:

- How is the hotel performing compared to your comp set?

- What are the prospects of recovery?

- What is the quality of the Team running the property?

- Do we believe in the Team or do we need to replace them?

We believe that demand will return in June, initially domestic travel but with further recovery in Q4. However, this will not be the desire V shape recovery but a more gradual one with RevPAR in 2021 being on average 37% below 2019 numbers, on par with 2010 levels.

In the absence of events, conventions and international travel, hotels will need to reposition and will remain in significant distress for the longer term. Hotel owners will need to apply significant scrutiny on the property performance vs. market vs competitors to take tough decisions whether they wish to keep running the property with the people running it now: Are they able to explain where they are and why?

References: STR Europe Hotel Analysis